Your Missoula City – County Property Taxes Explained

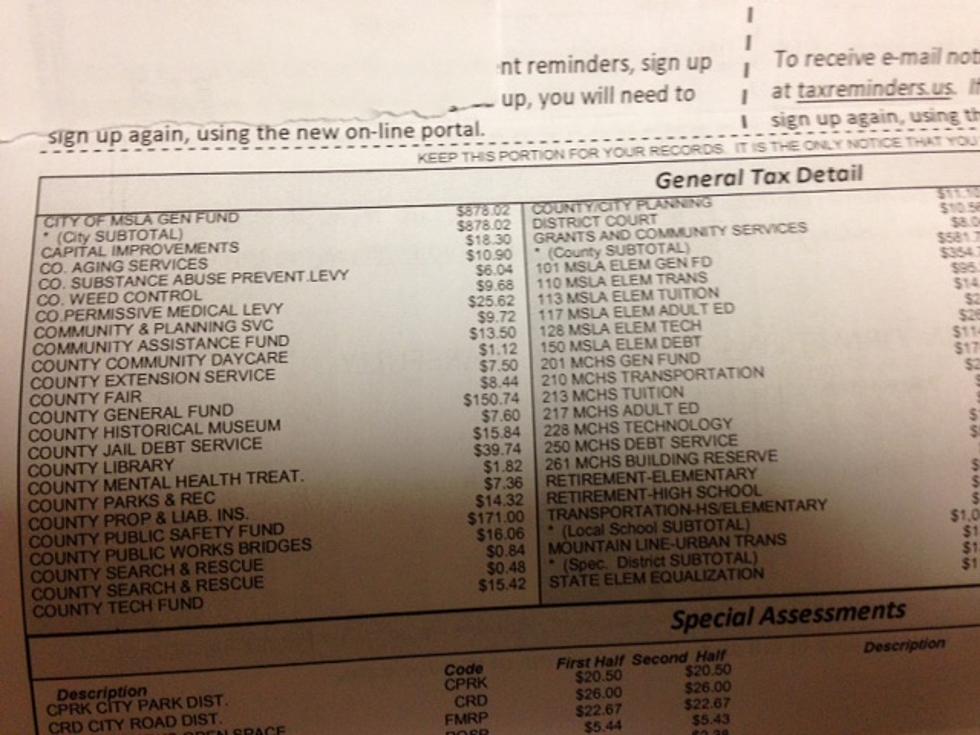

Thousands of property tax bills were mailed out this week, and property owners will see some changes in the way taxes are displayed.

Missoula City County Treasurer Tyler Gernant said the changes in tax bills are substantial.

"Obviously, property taxes fund local government and your local schools, Gernant said. "This year we made a pretty substantial change to the tax bill and actually broke out what your taxes are going toward, and you can see what your taxes are going for. For the most part you're looking at the fact that local schools take up a third, the city takes up about a third and the county tales up about a third."

Gernant said the results of two significant taxpayer-passed bond issues are showing up on this year's tax statements, including the $158 million combined MCPS levy passed in 2014 and the $40 million Parks and Recreation bond passed several years ago.

"About half of those school bonds have been issued and so about half of that is showing up on your bills," he said. "The other half are expected to be issued this year, and so the full amount will be on your tax bill next year.For the Fort Missoula parks bond, that is now fully issued, so the full amount is now on your tax bill."

Gernant said for any property owner who feels their property has been overvalued for taxes, there is an appeals process, however, the taxes must still be paid on time.

"You can pay your taxes under protest, and to do that you have to submit a written protest indicating why you're protesting, and you must also submit a form to the Department of Revenue," he said. "We strongly encourage people to contact the Department of Revenue if they do want to pay their taxes under protest."

Most homeowners pay their taxes through their mortgage company which collects the money in an escrow account, however, those who have paid off their homes are responsible for paying their own property taxes.

More From Newstalk KGVO 1290 AM & 98.3 FM