County Treasurer Tyler Gernant on Rising Home Values and Taxes

Missoula County Treasurer Tyler Gernant had a lot to say about property taxes in a visit with KGVO this week, but even more about the upcoming property valuations coming from the Montana Department of Revenue.

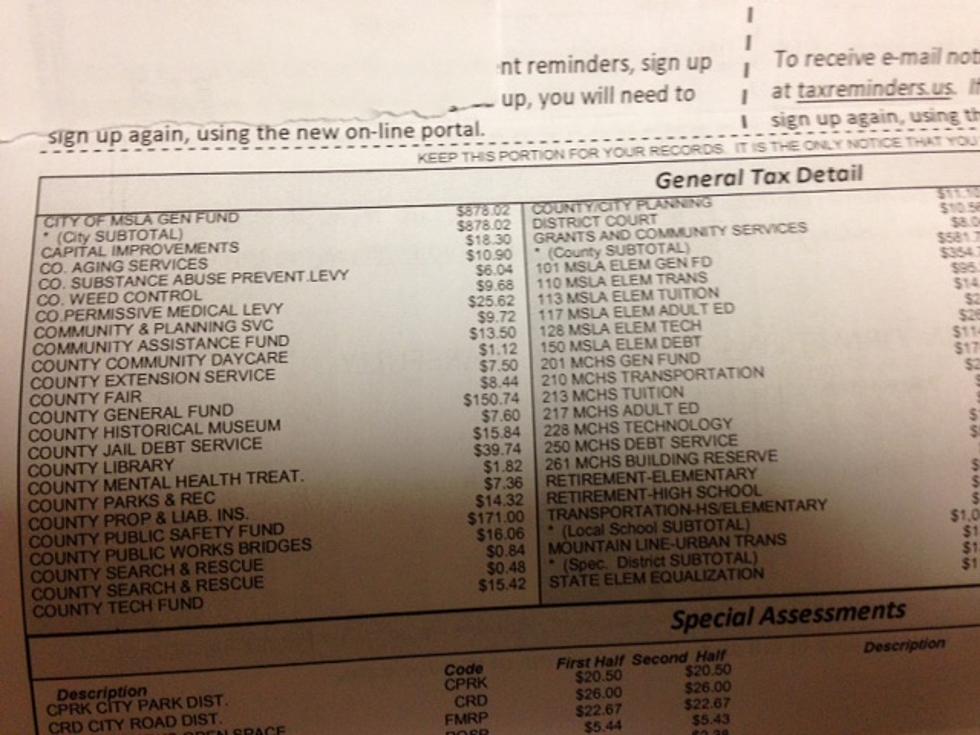

What you will be receiving, usually they go out in June but this year they'll be going out in July, is a reappraisal notice,” said Gernant. “Montana now sends out reappraisal notices once every two years and that's actually done by the Department of Revenue, but it's a very important piece of paper. So you want to keep that. About your tax bill itself, if you don't have it from when it was sent to you in October, you can always access it online by visiting Missoula taxes.us.”

Gernant explained his ‘good news-bad news’ scenario.

“Well, there's good news and bad news,” he said. “The good news is that 2020 will generally not be reflected in these valuations because they're effective as of January 1 of 2020. And so all of those values will not actually get reflected in what you're going to see in your July reappraisal notice. The bad news is that means two years from now, you'll get those, and the other bad news is that we were still going up quite a bit prior to that. So the two years prior to that saw somewhere around 10% growth in value as well. So you're going to see an increase in your values for almost everybody, I would expect.”

Gernant softened the blow somewhat with this comment.

“It's also important to note that when you get your reappraisal notice that its going to show what they view as your market value and your taxable value, and that isn't necessarily reflective of what your taxes will be,” he said. “The tax rate is set by the county commissioners and if you live in the city, it's set by the City Council and the mayor.”

Gernant said the rising property values and the taxes that go with them are a sign of a growing and prosperous community, but that the biggest stresses are always on those who live on a fixed income.

Gernant provided contact information for his office.

“The best way for me is email and my email address is on the county's website. But it's just t g e r n a n t at Missoula county.us,” he said. “It is really generally quite helpful for us to receive those emails because I try and respond as best I can. If you have questions, or if they're just comments, then I take them and I will a lot of times discuss them with some of the other officials who have a more direct role in actually setting tax policy.”

The next round of property tax bills must be paid by May 31.

The 100 Best Places to Live in the Midwest

More From Newstalk KGVO 1290 AM & 98.3 FM