Tax Study – Montana has Third Lowest Tax Rate in the Country

As much as we all complain about paying our taxes, here in Montana we are fortunate to have the third lowest overall tax rate in the United States.

Jill Gonzalez, an analyst with the financial website Wallet Hub provided details from her website’s research.

“This is good news,” said Gonzalez. “Right now in Montana, we're seeing the third lowest tax rate in the country, and that's a combination of things. That's not just property taxes or sales taxes. It's all of those mixed into one, and that's why Montana does so well. Right now the total effective state and local tax rate is around 7 percent, so for the average person in Montana, that's around $4,300 per year.”

Also through their research, Wallet Hub provided reactions from Montanans on how their tax monies have been spent, specifically by the federal government.

“Around 75 percent of people said that the government had not handled their tax dollars wisely during the pandemic,” she said. “That just comes mostly down to the federal government. They said that charities do better with that money; local government would do better with that money; and state government would do better with that money.”

On the subject of preparing a tax return, Gonzalez said parents must be careful of declaring child care expenses, especially during the pandemic.

“With childcare expenses, you might have less of them this year, but you still might qualify for certain income credits because you have children,” she said. “So that in terms of being affected, I don't think your taxes would be too affected. But I think in terms of childcare itself, just watch that you're not putting down the same numbers that you put for last year.”

When it comes to paying taxes, Gonzalez said to be wary of paying them with a credit card.

“If you have to do it, it certainly is an option. but I would probably want to open up a new credit card before April 15,” she said. “You usually need a few weeks lead time on a new card. If you can get a 0 percent interest credit card, that's the only time I think I would advise paying your taxes on credit.”

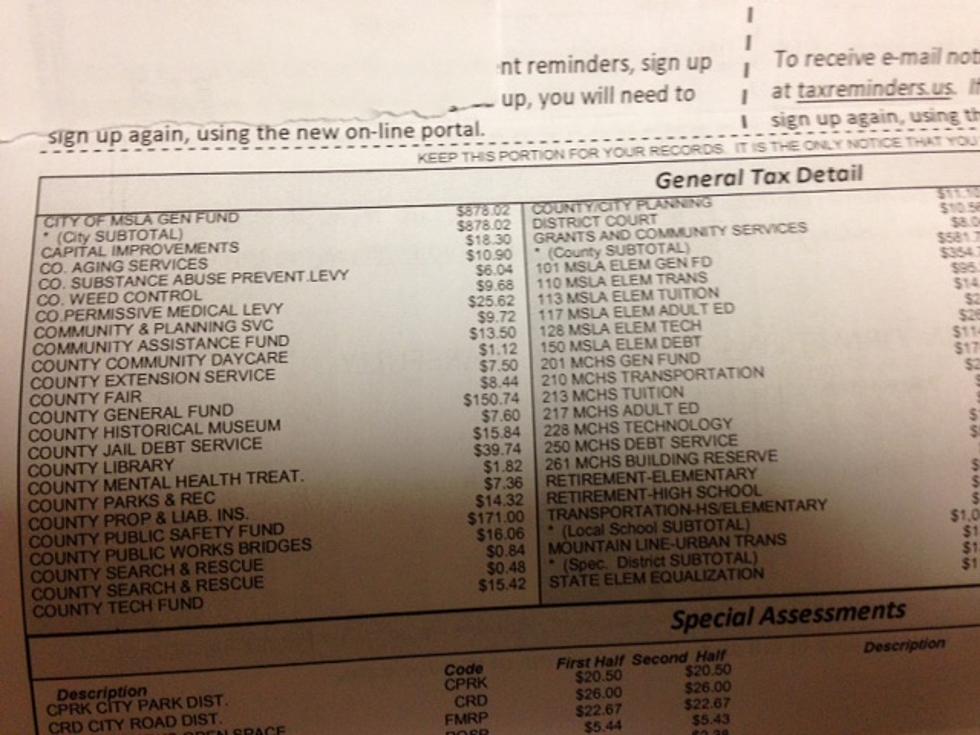

Here are Montana’s rankings when it comes to taxes in the U.S.

Tax Rates in Montana (1=Lowest; 25=Avg.):

3rd – Overall Effective State & Local Tax Rate

31st – Income Tax

20th – Real-Estate Tax

33rd – Vehicle Property Tax

2nd – Sales & Excise Taxes

At present, Montana does not have a statewide sales tax.

The 100 Best Places to Live in the Midwest

More From Newstalk KGVO 1290 AM & 98.3 FM