Property Tax Conversation with County Treasurer Tyler Gernant

Missoula County Clerk, Recorder and Treasurer Tyler Gernant appeared on the KGVO Talk Back Show on Thursday to answer questions from listeners on just that topic.

First, Gernant was asked to describe how property taxes are determined.

“”Your property taxes start with one very important part, which is the tax appraisal,” Gernant began. “That is since 1972, when Montana held its Constitutional Convention, and that duty was shifted to the state. So the state of Montana does all of your property appraisals. The Department of Revenue has local offices in each region that do that, and they will reappraise your property every two years for your market value.”

Once the appraised value of the property is determined, Gernant described how local entities become involved.

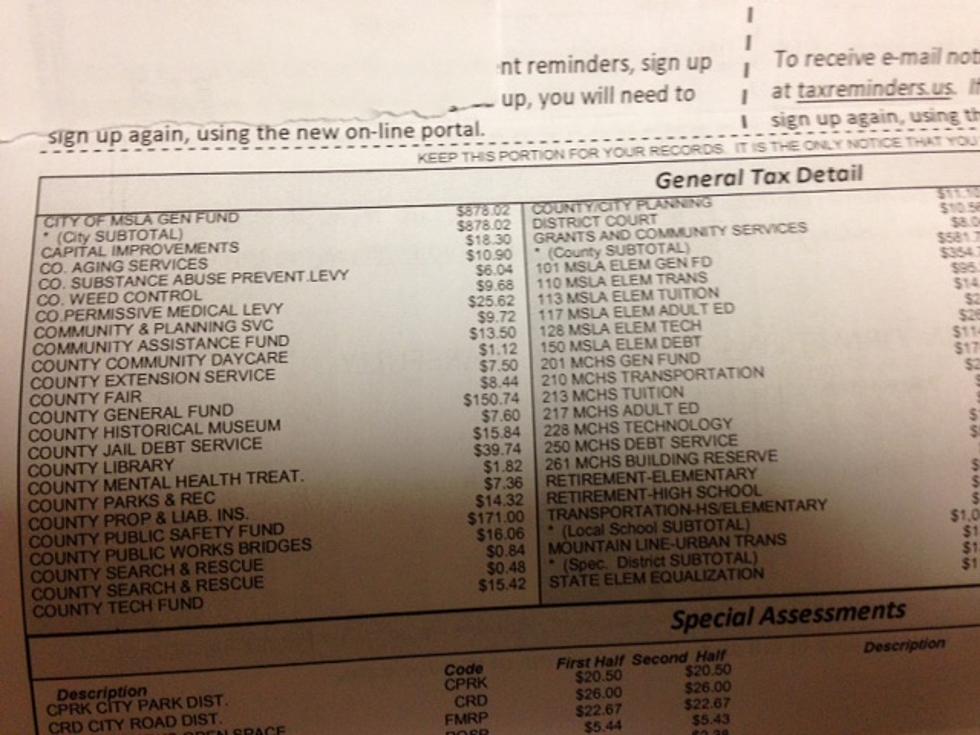

“Once you have your appraised value, that gets you your taxable value and it's based on what kind of property you have,” he said. “Residential property is taxed at 1.35% of market value and commercial is taxed at 1.89%. Then taking those values in the aggregate, your local government units, which means your city, your county, your schools and special districts will take that information and they are supposed to have already come up with a budget, then they take their budget and backend in the taxes to find out how much they need to assess in mills.”

Gernant was asked how a property owner might be able to better control their property taxes.

“Basically, in order to control your property taxes, you'd need to control your value,” he said. “Property taxes assessed by local government units, meaning the city or the county, can only go up at half the rate of inflation averaged over the last three years. So they can't go up a huge amount in terms of what they're assessing. The difference is really in that value (of the property), and of course, the value can go up however the market dictates.”

Gernant explained why as difficult as it is to swallow the increase in property taxes in this cycle, even bigger increases will come in the next two year cycle.

“These new appraisals that are coming out they are appraisals that are effective as of January 1 2020,” he said. “So in other words, it's looking at the value as of January 1 2020, which unfortunately means before the giant increase in property values in Missoula. So if you were to look back at January 1 2020, and think ‘Could I have sold my house for that?’ If your answer is yes, I wouldn't challenge it personally. If your answer is no, then you should go ahead and try and do an informal reappraisal that's really your best first step.”

Get more details by contacting the County Clerk and Recorder’s office at missoulatax@missoulacounty.us.

LOOK: Here is the richest town in each state

More From Newstalk KGVO 1290 AM & 98.3 FM