High Property Taxes – The Subject of KGVO’s Friday City Talk

Friday’s one hour Talk Back program was aptly named ‘City Talk’, due to the subject matter being discussed; property taxes.

(read to the end of the story to see some light at the end of the property tax tunnel.)

The guests in the KGVO studio included City of Missoula Communications Director Ginny Merriam, City Councilor Gwen Jones and Leigh Griffing, City of Missoula Finance Director.

Griffing started the conversation with a brief explanation of Missoula property taxes.

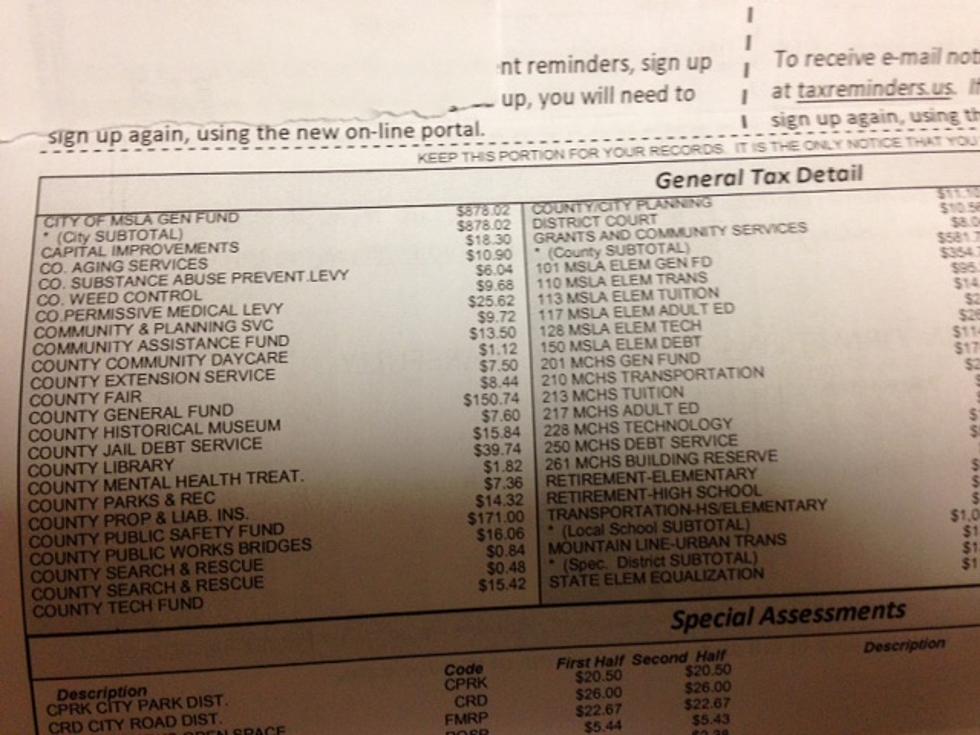

“So if you're a property owner within the city of Missoula, you will receive a tax bill every year,” said Griffing. “Only a portion of that will be from the city to pay for city operations. We're talking about streets and police and fire and so forth. But then the rest of your property tax bill will be coming to support the local schools; to support the county and all of their respective operations.”

Griffing explained the constraints placed upon the city as to how much property taxes can be raised from year to year.

“The city can only increase by half of the rate of the average of the last three years inflation,” she said. “But then if your property was valued by the Department of Revenue, and they do this every two years, they come in and say, ‘we think your property market value is this’ and then there's a calculation to have your taxable value. If they see properties increasing all around you, they're going to say your market value has increased as well, so therefore your taxable value has increased and you may receive a higher tax.”

Gwen Jones, who has taken it upon herself to study the history of property taxes in Missoula, explained her own personal property tax situation.

“I live kind of in the center of Missoula and in the year 2000, the property taxes on my house were $1,500 and now they are $6,500,” said Jones. “So, as a city councilor, I've been tracking this and looking at it and having heartburn over it because this is a completely unsustainable trajectory, and it makes budget all the more stressful.”

Jones looked back over 30 years and detailed how the tax burden has shifted more and more to the individual and commercial property owner.

“Back in 1987, across Montana 33 percent of property tax revenues came from residential and commercial,” she said. “By 2013, it was up to 63 percent, and here in Missoula in 2018, we were pushing 89 percent of our property tax revenue coming from residential and commercial. So, we're all paying it, because that's the way it's set up right now. I think we need tax reform. I think we need the legislators to look at this and figure out how we can start pulling dollars from other pockets.”

Jones is convinced that the Montana state legislature must develop a different property tax structure, because in her words, ‘the growth of property taxes in Missoula and all of Montana is simply unsustainable’.

LOOK: The Most Famous Actor Born Every Year

More From Newstalk KGVO 1290 AM & 98.3 FM