Property Valuations Are Every Two Years – Protest Period Over

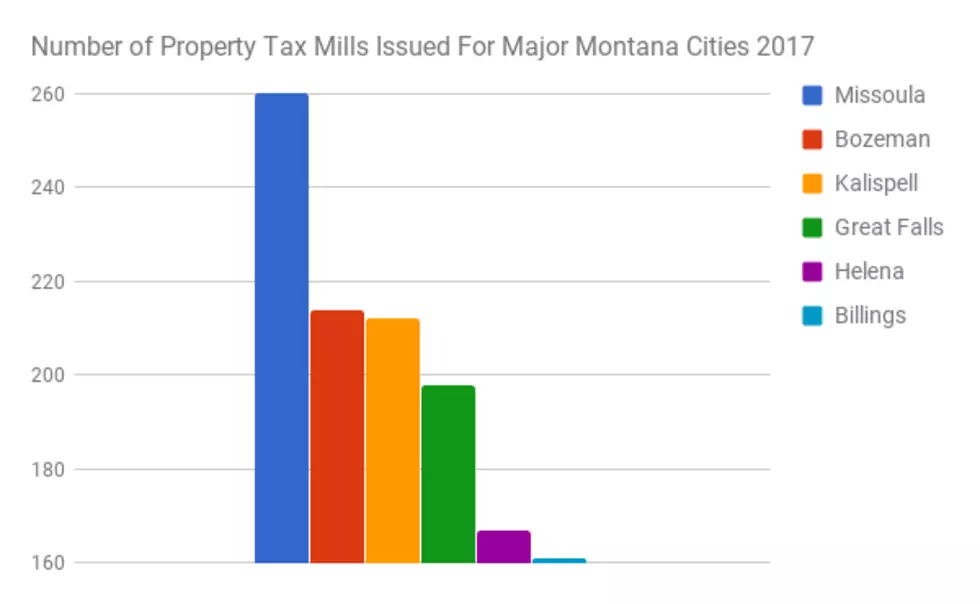

Property taxes, both residential and commercial, have become a hot topic in Missoula with the arrival of tax notices in the mail.

Missoula Attorney Quentin Rhoades appeared on Talk Back on Monday and related how one commercial property owner’s taxes rose by 116 percent over the last bill.

Director of Tax Policy and Research with the Montana Department of Revenue, Ed Caplis, said there are several factors that go into determining a property tax bill.

“The role at the Department of Revenue is that we assess value,” Caplis began. “The question is, did their property value increase that dramatically, or is it a combination of value increase plus an increase in the local mills?” he asked. “I’ve talked to some of our local staff there and there is updated sales data in that area, and they found that in the past they have undervalued those properties because the land values of many of those properties have increased.”

Caplis explained how the process of valuing property has changed.

“We used to have a six year cycle where we would go through and update everything,” he said. “Now, the state of Montana is in a two-year cycle. I’m not part of the property assessment division, but I would think that now they had a better model and they found that they had undervalued those properties, and the law requires us to do is to figure out the values, and that’s what we put on the books.”

Caplis explained how property owners can protest the valuation set by the Department of Revenue.

"You have what's called the AB-26, that's an informal request asking how the value of the property was determined," he said. "You get your valuation in June, and you then have 90 days to submit the AB-26. If you wait till November when your actual property bill arrives, then you're too late to protest for that year's taxes, however, you can still send in the AB-26 and then you'll work with our Missoula staff and they'll show you how they arrived at that determination."

When told how the increase in valuation has led to a big jump in property taxes for many Missoula residents, including multi-family dwellings where rents are being increased to cover the cost, he said that question is for policy makers.

“That’s a policy discussion,” he said. “The Department of Revenue values property and we’re required by law to determine what the property’s market value. How to soften that blow, that’s up to the legislature and the Governor’s office. They need to be asked that question.”

More From Newstalk KGVO 1290 AM & 98.3 FM