![Student Loan Interest Rates May Double in July [AUDIO]](http://townsquare.media/site/119/files/2013/05/grads-Mark-Wilson-Getty.jpg?w=980&q=75)

Student Loan Interest Rates May Double in July [AUDIO]

College students all over the country have their eyes on Washington, D.C. to see if Congress will allow student loan interest rates to double from 3.4 percent to 6.8 percent on July 1.

According to the St. Louis Journal , student loan debt, now totaling more than $1 billion dollars, surpasses both auto loans and credit card debt in the U.S.

Kent McGowan is the Financial Aid Director at the University of Montana. He acknowledged the possibility that rates could double for students, with the obvious result.

"Likely, what will happen is that students will continue to borrow because they need the loans to afford school," McGowan said. "of course, when they go in for repayment, if they take the full time for repayment, the amount of money they pay off for these loans will be substantially higher."

McGowan said in a recent interview that the average University of Montana student will graduate with a debt of nearly $25,000 over four years, and an interest rate twice as high will have a huge impact.

"It could literally be an extra one thousand to two thousand dollars in repayment on that amount of loan," McGowan said.

McGowan said students who graduate with a large amount of debt will have to make difficult life and career choices in order to pay off their loans.

"Debt probably doesn't affect their ability to get a job, as much as it does their life choices," McGowan said. "Whereas they might have gone for a job that was more beneficial for society, they instead might go for the higher paying job so that they can pay these loans off in the specified time. The debt would also delay the purchase of a new vehicle, the purchase of a home, the things you would expect a college graduate to do after getting their first job."

McGowan said all student loan repayment plans kick in six months after graduation. That being said, there are numerous repayment options available, depending upon the student's circumstances.

"There are different plans in paying the loans off in ten years where you do more interest only up-front, and then the size of the payments accelerate, with a balloon payment situation," McGowan said. "There are also now these income contingent loans where, rather than paying a set amount, the student pays a percentage of their income. Then, if the loans are not paid off completely in 20 to 25 years, then whatever balance that remains would simply be forgiven, but the standard plan the student agreed to, was to pay off their loans within 10 years."

For graduates who simply can't find a job, McGowan said help is available.

"A student may qualify for unemployment deferment if they can't find a job," McGowan said. "If they have a subsidized loan, they don't make payments, and the government will continue to pay the interest. If their loan is unsubsidized, they don't make payments, but the interest will continue to accrue."

McGowan said students should stay in close contact with their lenders and communicate their particular financial situation, so that plans can be made to protect their credit as they move forward with their lives. Many hope that President Obama will simply forgive all student debt at some point in the future, however, McGowan said that will probably never happen, due to the sheer amount of student debt.

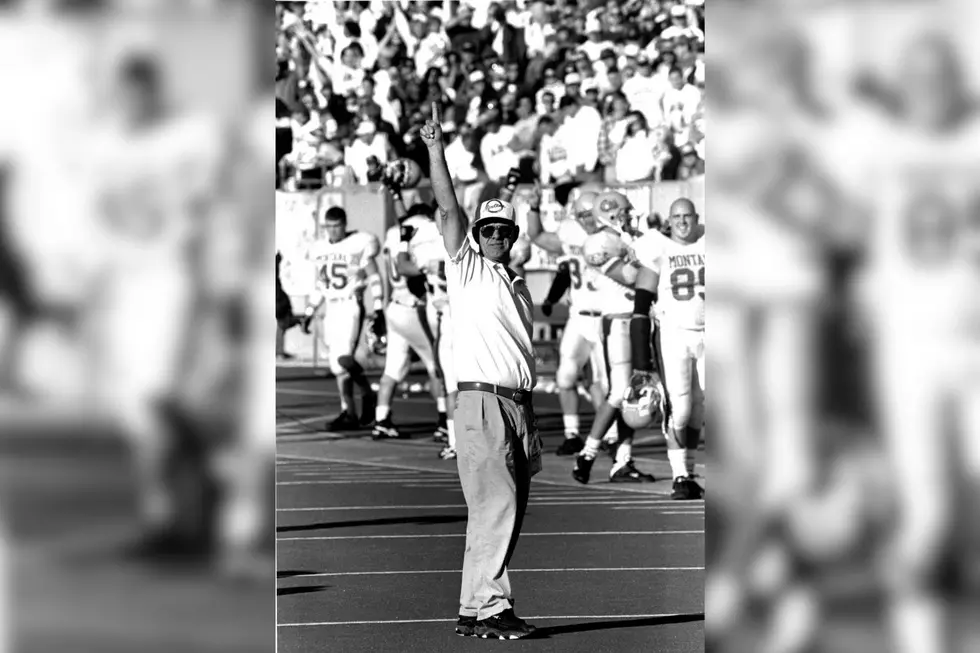

UM Financial Aid Director Kent McGowan

More From Newstalk KGVO 1290 AM & 98.3 FM