Montana Department of Revenue Releases 2014-2016 Biennial Report

The Montana Department of Revenue has released its 2014-2016 biennial report, Public Information Officer Mary Ann Dunwell describes the breakdown of where all of the state tax money went.

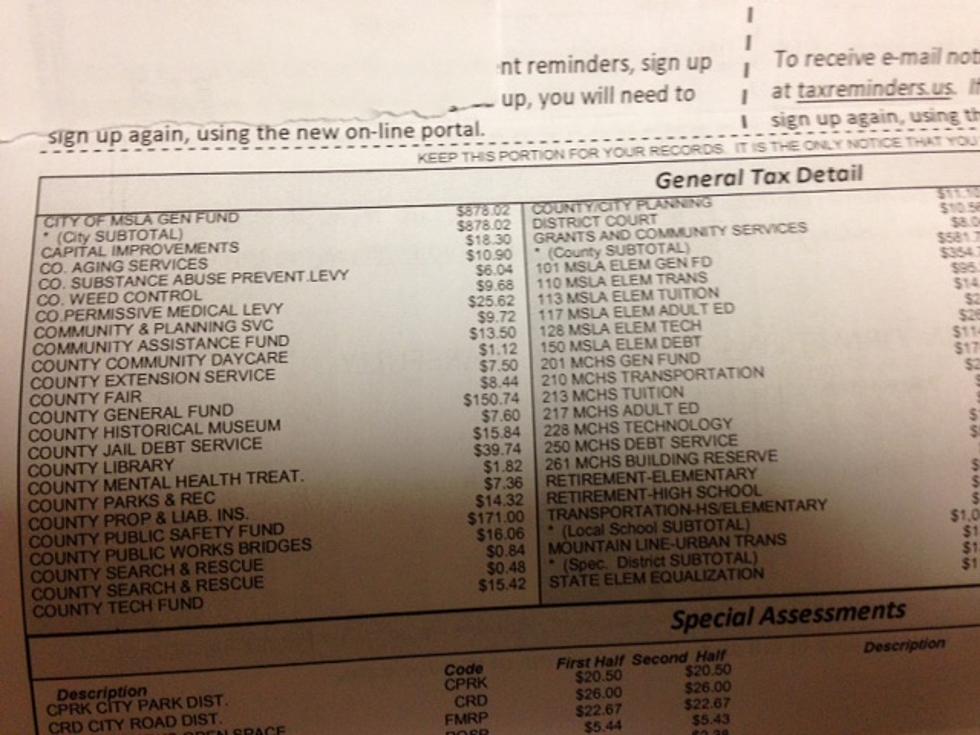

"It slices up to 32% education, 31% to public safety, welfare and health, 20% to natural resources and infrastructure, roads and bridges, 13% to administrative, legislative and judicial costs and then 2% to interest on debt," said Dunwell.

Weighing in at hundreds of pages, the biennial report isn’t an easy report to read, but it does included a ton of information.

"We administer 30 some type taxes and the biennial report drills down and explains each one and why they are administered, where the money goes, the breakdown and the funding streams," Dunwell said. "If you are curious about where your tax revenue goes I encourage you to read this."

The full report can be found at the Montana Department of Revenue website.

More From Newstalk KGVO 1290 AM & 98.3 FM