Can Your Race or Gender Affect Product Prices? — Dollars and Sense

All things being equal, you might think that everyone pays the same amount for car insurance, mortgages and health care coverage. But that’s not the case. Your gender, income and sometimes even your race can have a lot to do with how much you’re charged.

For example, in states where it’s allowed, nearly all insurance companies charge women higher health insurance premiums than men. Why? Insurance companies think women use health care services a lot more than men and that the additional cost is therefore justified.

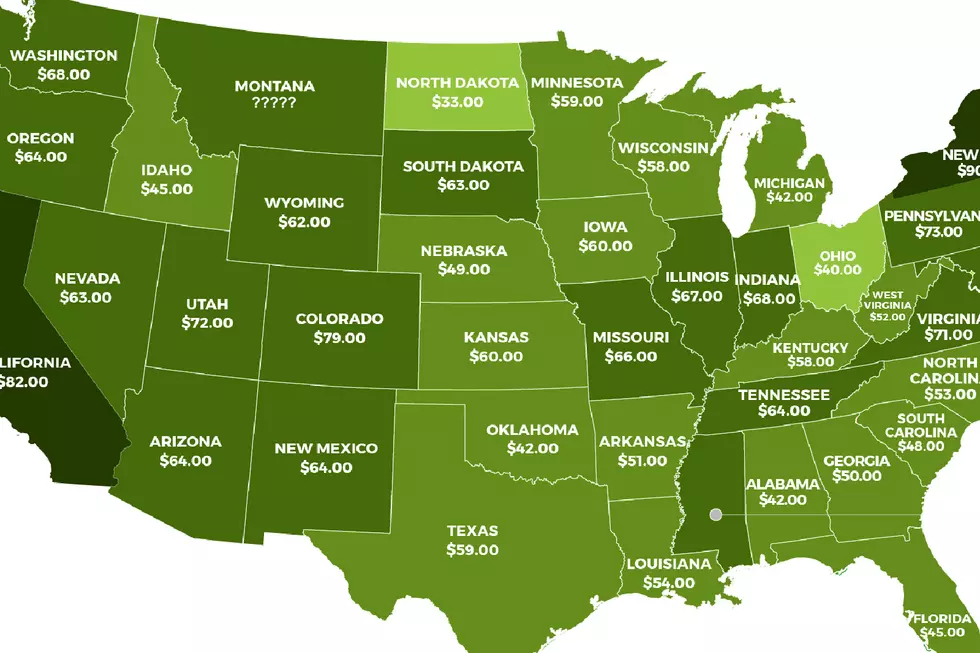

But women have the advantage with auto insurance, with one study saying they pay $15,000 less over their lifetimes for coverage. Younger men in particular shell out more, since they’re thought to be aggressive drivers who get into more accidents. People in lower-income brackets also tend to pay more since they often live in impoverished areas where auto theft rates are higher.

And if you’re buying a house, statistics show you’ll pay three percent more if you’re Latino and African-American than if you’re white. A recent report says sellers are “willing to accept a lower transaction price from a buyer that they deemed more likely to be able to secure financing and close the deal” — and whether it’s based in reality or assumption, African-Americans and Hispanics aren’t thought to fit that mold.

[Time]

More From Newstalk KGVO 1290 AM & 98.3 FM